When I used to step into Starbucks, I felt like I was being transported to another place. Inside, the smell of freshly roasted beans suffused the air. The rhythmic whirr of espresso machines at work was a reminder of the coffee being brewed. Baristas whizzed back and forth as they whisked up fiestas of flavor. Amidst the soft jazz, there was an ambiance of comfort and familiarity—one that begged me to stay as I savored every sip.

What started as a single, small coffee shop amidst the charm of Seattle’s Pike Place Market in 1971 has now grown into a $108-billion coffee colossus with over 38,000 stores across the globe. Inspired by the magic of Italian cafes, former CEO Howard Schultz had a clear vision for Starbucks to serve as a “third place” between work and home—a place where people can come together, share stories and indulge.

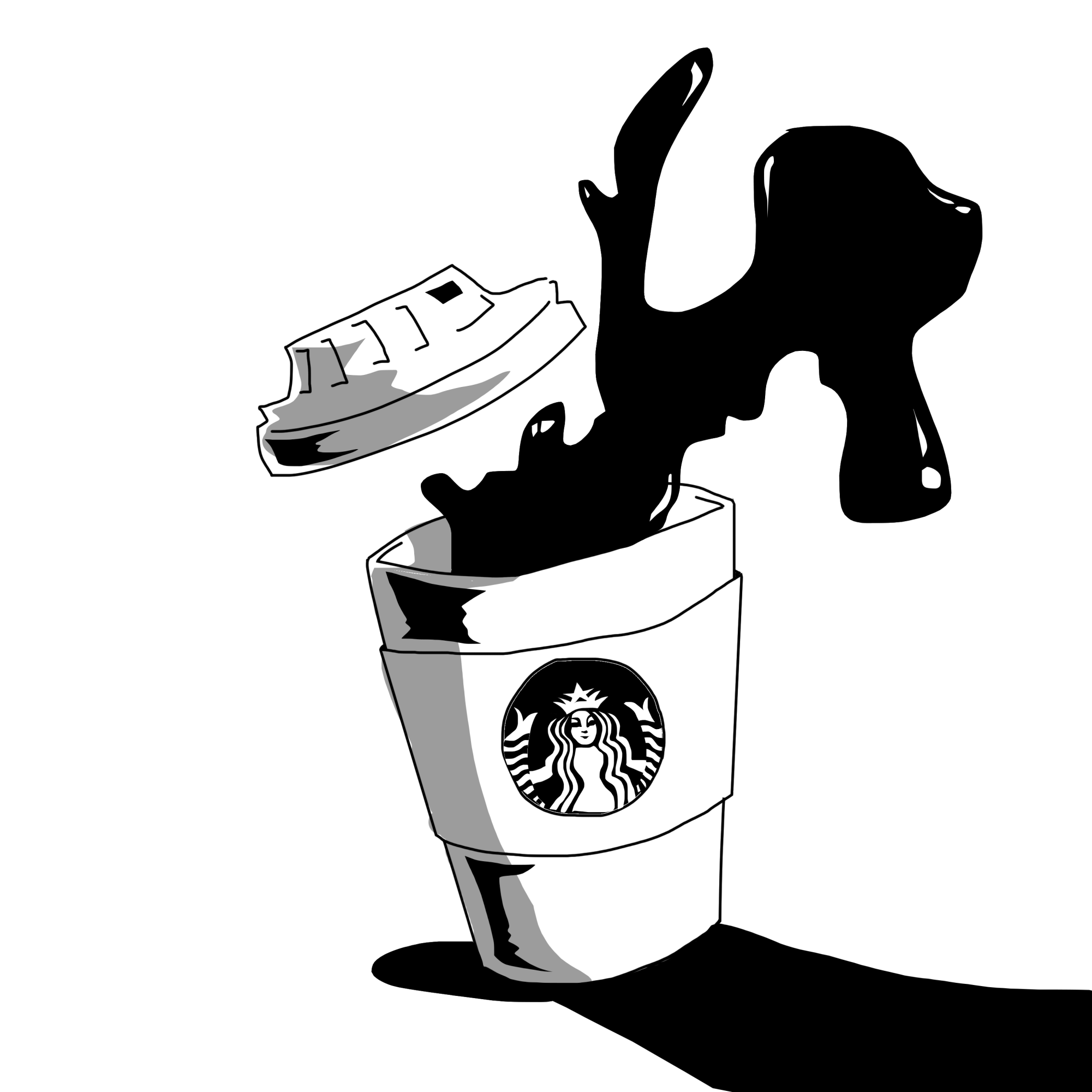

Recently, things have started to change. While the amalgam of jazz and the aroma of fresh coffee still welcomes me as I walk through the door, the coziness has vanished into a hectic frenzy: people on the go hustle in and out, the counter overflows with drinks waiting to be picked up by customers who ordered ahead on the mobile app and sparse seating no longer invites customers to linger long hours over a steaming cup of coffee.

Occasional customers and loyal Starbucks enthusiasts, it seems, have been feeling a similar way. The company’s preliminary release of their 2024 fourth quarter and fiscal year report two weeks ago appears to be frothing up more concern than the delight a dazzling Starbucks coffee date would suggest. For months now, Starbucks’ sales in the U.S. have been dropping. The 6% decrease in sales in the latest quarter compared to last year has made it the worst quarter since the pandemic, and the number of purchases has declined by 10%.

The fundamental problem? Going to Starbucks isn’t what it used to mean—and the brand itself no longer represents that “third place” it used to be. Instead, that place is getting lost in the company’s self-commoditizing marketing machinery.

For starters, printed labels on cups have taken up the spot of once upon a time handwritten names and pick-me-ups in black sharpie. Every beverage is given the appearance of a ready-made sealed product, hiding the authenticity and uniqueness of the handcrafted drink within.

What’s more, Starbucks has concocted a seemingly endless and bizarre menu of drinks infused with an exhaustive list of customizations. From the notorious “unicorn frappuccino” to toffee nut syrup, these ‘extras’ fail to deliver the true Italian espresso culture and premium quality coffee experience to the everyday consumer.

Starbucks coins it “experiential convenience”—the increasing shift to mobile ordering over in-person transactions. The goal is to make every step in the experience—from ordering to drinking coffee—as effortless for the customer as possible. Yet those wishing to enjoy their coffee in-store will find themselves literally rubbing elbows with in-and-out convenience buyers. Coffee shop enthusiasts may not even find seating altogether, as cafes are removing chairs and tables to make room for their ever-growing digital ordering culture.

Still, what has perhaps been stirring up Starbucks customer turnover most are the staggering beverage prices. It is rare to leave the store without having spent at least $5 on a drink, even finding menu items under $4 is quite the feat. Instead, customers are beginning to turn to Starbucks’ fierce competitors: cafes with a “neighborhood coffee shop” feel and supreme coffee flavor, and the number of fancy coffee makers tucked away in peoples’ kitchens and workplace offices.

To address the stifling number of sales, new CEO Brian Niccol has a “Back to Starbucks” plan on the menu. “We’re reclaiming the third place, so our cafes feel like the welcoming coffeehouse our customers remember,” Niccol said.

First and foremost, mobile ordering, with a reduced number of customization options, will be taking a backseat to focus on elevating the in-store ambience. More comfortable seating, coffee served in ceramic mugs and the return of the black sharpie are supposed to breathe new life into the sparkling allure that once kept customers coming and encouraged them to stay.

Other changes include a maximum wait of four minutes, a less exhaustive drink menu, no surcharge on non-dairy milk, increased staffing, fewer discounts that overwhelm baristas and a revival of the pre-pandemic condiment bar.

Perks like free milk substitutes and the condiment bar certainly sound enticing—and the emphasis on bringing back that “third place” Starbucks strives to represent seems to be serving up the right vision. But a major problem Niccol’s plan fails to address are the drink prices, which have been blown significantly out of proportion and are a major source of pushback from customers. What’s more, changes like store redesigns, comfier chairs, ceramic mugs and increased staffing will require considerable investment, and it remains to be seen how, and if, this will reflect onto the consumer, hiking up prices even more.

Niccol appears not to consider this brewing concern. “We have a clear plan … I’m very optimistic,” he said. Only time will tell how effective Starbucks’ turnaround will be, but it’s clear that the company has some serious re-envisioning to do. And maybe, just maybe, it will once again swirl up some magic—that indescribable feeling of sipping in surprise and delight.